How Investments in Stat-ups pay off

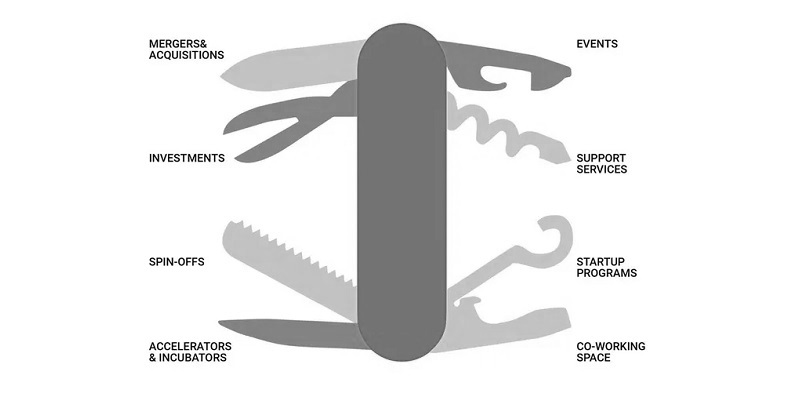

Corporate Venture Capital (CVC) can accelerate internal innovation efforts, but it entails many risks. In internal innovation vehicles such as venture studios or accelerators, you are looking to accelerate the development of promising innovations. An accelerator’s constituent ventures might partner with other companies, but that’s not CVC. With CVC, corporate capital is invested directly into other companies, usually as a strategic investor with minority stake.

Key drivers for interest in CVC are competitor landscape is broader than before. It is not just few established players but numerous start-ups that are reaching scale. Many executives also believe their due to new technologies like AI, blockchain, Internet of things, autonomous vehicles, AR/VR, are putting the traditional business models under threat. Also, time to scale is reducing drastically. External innovation thus becomes very important, for need to scale fast and with non-traditional business models.

Things are changing over time. From 1990s and early 2000s, CVC funds tended to invest at a late stage, are now going for early-stage. Having gained experience and sharpened their strategy, CVCs are also dipping into seed-stage territory.

CVC is a long-term gambit. Corporate should be able to define the rate of success over a long-term period of minimum five years to a decade. Expecting financial or strategic returns quickly would be foolhardy.

For CVC to succeed, first, strategic objective and right vision is important. Is it access to capabilities, a new market, insights or what? It is important to understand from the outset what success means because that will shape the deal flow.

Second, it is needed to align the type of ventures you want to invest in. Companies often lack coherent investment theses or search areas. You need a core theme such as entering a new product type, or geography or business model, and building a portfolio of similar companies in that space.

Third dimension is to formalize the operating model. The CVC fund needs a dedicated team with specified roles, not just one person doing it part-time. It will need well-defined governance. There will be a budget. There will be agile investment decisions. Consider it an investment vehicle, for returns – strategic or financial or both.

From Matt Banholzer, McKinsey’s Podcast with Sean Brown